PRIME Phase 2 Specific Questions

What are the eligibility requirements in order to apply?

- Your business has a significant presence in Maine (50% of employees in Maine or headquarters (HQ) in Maine).

- Your business is registered with Maine Secretary of State’s corporate registry. If you are a sole proprietor and not registered with the Secretary of State, you can use alternate methods:

- Upload a copy of last year’s 1040 and Schedule C for your federal income tax

- Provide self-certification that you are an engaged proprietor of this business

- It is important that your business must be in one of the seven industry sectors identified by state statute and listed here.

- Your business plans were negatively impacted by the COVID-19 pandemic and your application can clearly articulate and provide details of that damage

- You can demonstrate a clear plan to utilize PRIME 2 Funds to directly address the negative economic impacts of the COVID-19 pandemic, suffered by your business here in Maine. Your application will include a plan to use the award to stabilize or grow your business.

- You are able and willing to comply with simple annual reporting updates that may be required by State and Federal law

Your project will use the funding, and the project you propose will be completed by June 2026.

How much funding can a company request?

We expect a large number of applications, and the total funding requested may exceed the funds remaining, ($7.5M). The state legislature determined that $34M of total ARPA funding would be made available to this segment of businesses in the state. The $7.5 M is the amount remaining after we have completed other rounds of PRIME funding over the last 2 years. As part of that ARPA allocation, the legislature directed MTI that this grant funding must be granted on a competitive basis and the amount must be matched by the recipient. All applications will be reviewed by staff for match and then scored to determine competitive ranking. Applications with the higher scores will receive grants.

The maximum requested award will be $250,000. Depending on the number of high-quality applications we receive, awards may be less than the amount originally requested by the applicant. If the reduced award would prevent you from completing your proposed project/plan, there is no obligation to accept the grant offered and no ongoing reporting requirement.

How will the applications be evaluated and scored?

Each application will be reviewed and scored by a qualified reviewer. The application will be reviewed against a scoring rubric with approximately 100 available points. The scoring rubric is as follows:

- 40 points on quality of the proposed project to achieve stability after the pandemic and foster company growth

- 10 points if company is female or minority led

- 10 points if located in a disadvantaged area of the state as defined by the 2020 census and economic data provided by the state

- 20 points awarded to companies that are new to MTI (companies that have not received prior MTI funding)

- 10 points for cash match that exceed 1:1 (scaled based on amount over 1:1)

- 10 points for depth and experience of leadership team

What qualifies as a “negative impact of the pandemic”?

A company’s “negative impact” can be defined in multiple ways. The easiest way is to demonstrate a revenue decline or a reduction in revenue growth during and after the pandemic. Some other ways include:

- Supply chain disruptions that caused a reduction in production or revenue

- Worker unavailability due to illness or child or elder care responsibilities

- Distribution disruptions

- Other resource limitations that caused a delay in a new project or the start-up of a new company or product line or subsidiary

- Customer closings that caused a decrease in demand or increases in receivables or bad debt

Companies should think broadly about the damage the pandemic caused their business. These federal funds are aimed specifically at mitigating the damage caused by the pandemic. In the application, you will be asked to explain how the pandemic damaged your business or delayed your plans and how this funding supports a project that mitigates that damage.

When can awardees expect funding?

The PRIME 2 application portal will close on August 30, 2024. We anticipate it will take 4-5 weeks to evaluate and score each application. We expect to make final award announcements in October. Awardees will be sent a short contract along with the award notification. That contract ensures that the funds will only be used in the State of Maine and for the project submitted as part of the application. In addition, the awardee certifies that they will cooperate with all reporting requirements or they will be asked to return the funding to MTI. Assuming that they have submitted all the other paperwork needed and have signed the contract and returned it to MTI, funds can then be released.

Will companies with a significant Maine presence, but out-of-state ownership, be eligible?

Companies with a “significant presence” in Maine are eligible to apply – even if the company’s headquarters (HQ) or state of incorporation is outside of Maine. A “significant presence” is usually defined by MTI as a company with more than 50% of its employees in the state or a short-term plan to achieve more than 50% of its employees within the state.

Will prior MTI awards impact eligibility?

This program is a stand-alone initiative and prior award(s) or declinations will not impact eligibility for a PRIME 2 award. PRIME 2 Funds are federal funds supplied by the state and administered by MTI. MTI is anxious to use this funding to deliver support to new technology companies in the state and companies that have never received funding from MTi previously. Consequently, a small scoring bonus will be given to “New to MTI” accounts when calculating the final score.

How much detail is needed in the application for the PRIME 2 Funding? If I have Excel spreadsheets and Word documents already created to support my plan, can they be uploaded to the MTI Online Portal as part of my application?

The purpose of this funding is for recovery and sustainable growth for our companies in Maine’s 7 technology sectors. The plan you submit with your application should provide the details of how the funds will be used to achieve those goals for your company/organization. If plans have already been created using Word or Excel, those files can be uploaded and referenced in your application. Your plan should be brief but contain the goal you expect to achieve (new hires, revenue growth, client churn rates reductions, employee churn rate reductions, etc.). Please note that exceptionally long or detailed applications do not generate additional points in the scoring. Be brief but explicit in your responses. If a reviewer has a question, they may reach out via email for further explanation and your response will become part of the total application submitted.

Companies are asked to think broadly about steps they could take in their businesses that would cause transformative change and resiliency. If the program you envision causes real stability and an opportunity for growth of your firm, it may be a good candidate for funding from the PRIME 2 Fund.

What options – other than MTI – are available to receive federal funding?

There are many other state, regional, and municipal organizations that are also administering portions of the available federal funding. If you apply for the funds administered through MTI’s PRIME 2 Fund and are not eligible, or if your award is less than you expected or need, we will connect you with other American Rescue Plan Act (ARPA) funding options that may be a better fit for your business. As these funds become available, they are posted on the Maine Jobs and Recovery Plan (MJRP) website found here.

What is the deadline for the application?

The deadline for this round of applications is midnight on August 30, 2024. If we have questions about your application, we may reach out upon receipt or during the scoring period in September.

What are the reporting requirements from MTI?

The dollars awarded from this program are funded from the federal government and the American Rescue Plan Act (ARPA). Maine has specific reporting requirements back to the federal government on a quarterly basis that are primarily updated on the flow of funds to qualified companies. However, we also supply yearly data to the federal government on the long-term economic impact of this funding in our state. In order to capture this data, MTI will be sending annual online surveys regarding your project and company impact. The survey takes approximately 15 minutes to complete.

Will I need to sign a contract with MTI if I receive an award?

As an applicant and as part of your uploaded documents you included a signed Grant Application Agreement certifying the accuracy of all submitted data and agreeing to all rules established by MTI or the Federal government for such grants. Awardees will need to sign a short contract that will be sent to them along with their award notification in October. That contract ensures that the funds will be used in the state of Maine for the project identified in the application and that the awardee will comply with all reporting requirements.

How much support will MTI provide to prospective applicants developing their proposals?

We recognize there may be parts of this application that require some assistance. With previous ARPA programs we administered, we found that Zoom conference calls open to all awardees were an effective forum to answer questions. On the MTI website for PRIME 2 you will find a link to register for any of the 4 sessions planned. Click here for schedule and registration information. If the question is very specific to a business, we may ask to move you into a Zoom breakout room where you can get individual assistance or we will set up a time for a one on one call. Meetings will be recorded and posted and if a question is not already in our FAQ list, we will add it as a response for the benefit of future applicants. We have also created a mailbox that will be monitored by the staff to answer questions that are emailed to MTI. We hope to answer all questions within 1 business day. That email address is ARPAGrants @mainetechnology.org.

For future economic impact of the funding, can we count total employees added even if some may not be in Maine? What else should we include for economic impact?

As you execute the plan outlined in the application, we would expect that your business will achieve new levels of recovery, success and stability. Recovery and growth are usually reflected in revenue growth of the company over time, and either the retention or growth of existing quality positions at the company over time. We recognize that some positions are best staffed outside of Maine. As long as the company maintains its headquarters or a significant presence (see above FAQ) in Maine, MTI will allow a company to count non-Maine based employee growth in the economic impact goals outlined in the application.

What are some examples of unallowable expenses?

Funds must be used to implement your plan and directly address negative impacts of the COVID-19 pandemic. Types of expenses which would NOT be allowed include, but are not limited to, the following:

- Entertainment

- Lobbying

- Goods and Services for Personal Use

- Litigation

- Fines, Penalties, Damages and other Settlements

How do I get or find my Unique Entity Identification (UEI) number and is there any cost to me to obtain a UEI number?

On April 4, 2022, the unique entity identifier used across the federal government changed from the DUNS Number to the Unique Entity Identification number generated by SAM.gov. The Unique Entity Identification (UEI) number is required and free to obtain. We will need to report all awards to the federal government and include the UEI number for that account. The application will request you to fill in your UEI.

- The Unique Entity Identification number is a 12-character alphanumeric ID assigned to an entity by SAM.gov.

- As part of this transition, the DUNS Number has been removed from SAM.gov.

- Entity registration, searching, and data entry in SAM.gov now require use of the new Unique Entity Identification number.

- Existing registered entities can find their Unique Entity Identification number by following the steps here.

- New entities can get their Unique Entity Identification number at SAM.gov and, if required, complete an entity registration.

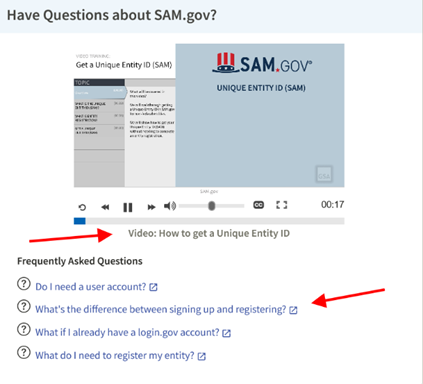

- The SAM.gov website has a video and a list of FAQs. (Videos can be found halfway down the SAM.gov page.)

- Please note – the registration process allows you to obtain just a Unique Entity Identification (UEI) number or also to register your business so that you can bid on government contracts. The video indicates that you need to register your entity to get federal awards. The award you are applying for through PRIME 2 Fund is NOT a direct federal award. Unless you plan to bid on government contracts most applicants for the PRIME 2 Fund only need to sign up for the UEI number. (Easier and faster.)

- If you have attempted to register your UEI number with SAM.gov but have received a message stating your request requires further review, you can still proceed with MTI’s online application for the PRIME 2 Fund. Click here to learn more. However, please note that we cannot make any award payment if the UEI number has not been given to the firm from SAM.gov.